#6 • Examining your dental practice’s monthly bank statement

OUR BLOG HAS MOVED!

This blog was last updated in 2019.

#6 in our series of #TIPS intended to help you deal with fraud, embezzlement, waste, and abuse in your dental practice.

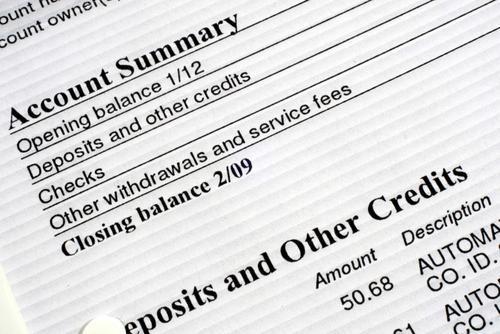

“The Monthly Bank Statement”

Depending on how your banking arrangements are set up, you may receive your “Monthly Bank Statement” in the mail, or download it using your online banking.

Here are a few suggestions to follow each month.

Access to bank records.

(PAPER) Statements should be mailed to a home or other address that is not accessible by employees.

(ONLINE) The practice owner should be the only person with access to the practice’s online banking. Unless there is a compelling reason do otherwise, bookkeepers and CPA’s should be limited to “view-only” access.

Automatic withdrawals

(BOTH) Do you recognize them all? Is the amount correct?

Bank fees / reversals

(BOTH) Look for bank fees, NSF checks, reversals and overdrafts on your account that you do not recognize.

(BOTH) Look for bank fees, NSF checks, reversals and overdrafts on your account that you do not recognize.

Check endorsements

(PAPER) Look at the reverse side of each cancelled check for proper endorsement. Do the names match?

(ONLINE) View check images and look reverse side image for the proper endorsement. Do the names match?

Checks / payments

(PAPER) Look at each check written on your account. Do you recognize the name on the check?

(ONLINE) Look at each payment listed on your statement. Do you recognize the name of each payee?

Debits and transfers

Look for transfers or debits to your account that you do not recognize.

Multiple checks or payments

(PAPER) Make sure the number of checks issued to a supplier or vendor matches the number of invoices you paid.

(ONLINE) Make sure the number of EFT payments issued to a supplier or vendor matches the number of invoices you paid.

Payroll

(PAPER) If you pay your employees by check, make sure the total number of checks each month is correct, and the number of checks issued to each employee is correct. (did someone get paid twice? Is there a “person” on your payroll you do not recognize?

(PAPER) If you pay your employees by check, make sure the total number of checks each month is correct, and the number of checks issued to each employee is correct. (did someone get paid twice? Is there a “person” on your payroll you do not recognize?

(ONLINE) If you pay employees using electronic funds transfer, make sure the total number of transfers each month is correct, and the number of transfers issued to each employee is correct.

Record keeping

(PAPER) DO NOT STORE your monthly statements in the practice. Keep them in a cool, dry and secure location; like your home office.

(PAPER) DO NOT STORE your monthly statements in the practice. Keep them in a cool, dry and secure location; like your home office.

(ONLINE) DO NOT KEEP copies of your bank statements on an office computer. Save your statements in a secure location offsite.